Taking Back Our Value Metrics

It is our time to choose our future, by choosing how we transact and communicate value.

Reflecting on how we got here

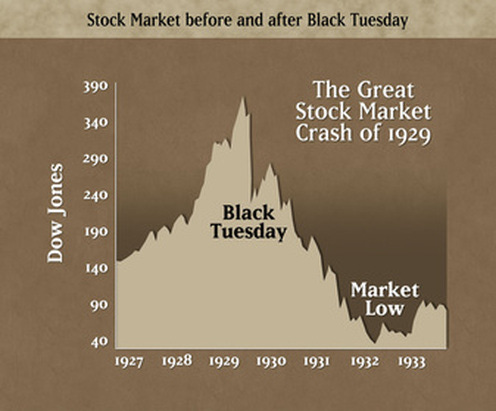

1933: the Great Depression devastated the global economy. Citizens sought monetary stability, so they protected their wealth by holding precious metals, rather than depositing their bullion into the banks. Many nations failed to uphold their gold-standard currencies in this period, because the banks did not have enough gold in their vaults to meet their reserve requirements. The US commercial banks and Federal Reserve were no exception. It was this year that the US ended their domestic gold standard transactions.

Less than 40 years later, they continued this disastrous experiment, by ending the international gold convertibility of the dollar in 1971. Forgoing, the dollar had no ties to any laws of scarcity; it became printable on demand. Instead, citizen debt, momentum of cash flow, and the military-backed petro dollar became the new key mechanisms by which the US established its fiat currency as the new global standard metric of value.

On the cusp of The Great Reset, these days are coming to an end, but what will take its place? Will we obediently switch over to the dominating fiat currency of the next global superpower, and sign up to repeat the same hyperinflation disaster down the road? Will we acquiesce to a new central bank digital currency, placing god-like dominion over our lives in the hands of an illusive few? Is there a better way?

Looking for Solutions?

There is no way to save the current economic structures. Unfair systems based on theft and dishonesty do not remain prosperous, so there is no point in saving the current economic structures, and in my opinion it is impossible to do so. What´s more, if we continue to follow the path set before us by sociopaths and mystics, we will continue to live as tax slaves. Solutions must be practical, and within reach. I believe that the solution for our present situation was ingeniously laid for us in Ayn Rand´s fictional masterpiece; Atlas Shrugged. Combing the solution of a peaceful strike of productive members of society with technologies available to us today, we can exit the systems which abuse and steal from us, while the parasitic mystics and government structures starve in the absence of a host. We are the enablers of our enslavement, and the key is to give a peaceful “no”.

Merits and shortcomings of Keeping it Cash:

Paying for everything in physical cash, and boycotting companies which go cashless, will slow down the surveillance state´s implementation of CBDCs and decrease data collection of public spending. This will make it burdensome for companies to abandon cash payments and slow things down at the corporate level. This a fantastic immediate move, but isolated from combined tactics it is unfortunately a futile strategy. By doing this, we are attempting to stall as long as possible at an earlier technology of the unfair fiat currency system, but we do not address the essential migration to a fair medium of exchange. In other words, even our use of cash continues to legitimize fiat currency and enrich the money printers.

Rethinking our value metrics

The use of fiat currency as our metric of value is a critical obstacle which we must overcome. At best, fiat inflates at 2% a year, but we´re now undergoing hyperinflation of at least 8%, and I expect this will continue. Overlooking how the consequences fall upon the people as cost of living skyrockets, if we continue to measure cost with fiat metrics, we have no way to accurately and mathematically communicate value!

Bitcoin is deflationary, and is 14 years into a 100+ year process of stabilization. Within decades, Bitcoin will be so stable, that I expect its use as a mathematical metric of value will be popularized - similar to meters for distance, and liters for volume. However, this will take more time, and though already popular among technologically advanced circles, I do not believe the whole world is ready for this solution yet. First, the destructive fiat associative ideology must be dissolved. With current trends, it will not take long before hyperinflation runs its destructive course, but will the people know better when this is said and done?

For now I propose that we use gold as our metric of value, even if we use other sovereign payment methods, like Bitcoin over the internet. Using grams instead of ounces may be a superior metric, because smaller amounts can be displayed with greater ease, but ounces is already a popular metric for bullion and the transition would likely be easier. Silver is another viable option, though the market for it is heavily suppressed at present.

Here is a thought provoking right-side up inversion. As of February 8th 2023:

1 USD = 0.000533 AUX oz

Custodianship: Taking Responsibility

Delegating custodianship of our finances to third parties is the root of our problems. These parasitic organizations use the headroom of their monopoly to take everything within their reach. Our funds are not safe with them, and can be frozen by demand of the government.

Whether we store our wealth in cash, gold, silver, infrastructure, solar electricity, tractors, canned tuna, or Bitcoin held in proper self-custody, we can access and use our wealth without permission – that´s ownership! This last point is simple. In whichever form you choose, be the custodian of your own fortune.

In Closing

Money is the blood of society. If the money is bad, the society will be systemically sick. It is our time to choose our future, by choosing how we transact. The actions of individuals are the seeds of the collective harvest. Nobody else is coming to save us; we are the ones we´ve been waiting for.