The significance of the Bitcoin halving cycle

The Halving is an event which occurs every 4 years, when the reward for mining Bitcoin is cut in half.

In extreme contrast to inflationary fiat currencies, Bitcoin is deflationary; it becomes more valuable over time. After its creator in 2009 by its illusive inventor Satoshi Nakamoto, enthusiasts celebrated when the fiat-denominated value exceeded $0.01. By 2010, it was valued at more than $0.05, and today one Bitcoin is priced at over $23,000. In the last seven years alone, the value in relation to fiat has risen by 6,000+%.

How is this possible? In addition to being a superior money system, this dramatic rise in perceived value is caused by a part of Bitcoin´s own algorithm; it´s called The Halving.

What is The Halving?

As you may know, Bitcoin uses a blockchain ledger with timestamps of 10 minute “blocks”. This is a security protocol designed to protect the network from double spending. For every block, there is a race between computers (we call them “miners”) around the world to solve a SHA-256 encryption, and the difficulty is automatically adjusted so that this takes approximately ten minutes. The winner is rewarded with Bitcoin, and the network is kept safe from a wide range of threats.

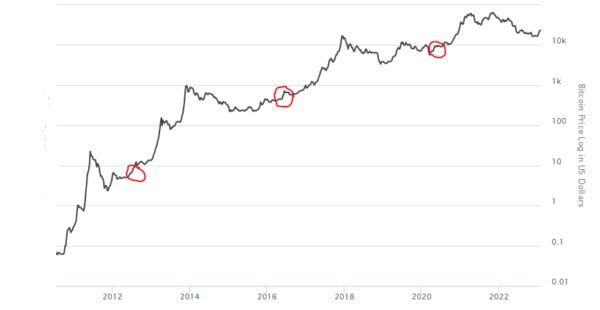

Every 210,000 blocks (approximately 4 years) the reward is cut in half, and this causes a dramatic spike in the perceived value of Bitcoin, because of a sudden shortage of supply. This may be the most fundamental point to understand before investing in Bitcoin. The price is volatile by the nature of this early chapter in Bitcoin´s history, and the strong hands win. Below is a logarithmic graph of Bitcoin prices since 2010 – approximate halving dates have been circled in red.

The implications of deflationary money

The implications of this for humanity are incredible; a civilization which uses Bitcoin as its standard medium of exchange would be steered away from buying things that they do not need, because money would be worth more (in scarcer supply) the longer they save it. In contrast, inflationary fiat currencies encourages spending because it constantly depreciates in value. In other words, those who save their dollars lose a big chunk of their wealth every year, and this is by design to keep the liquidity as high as possible. Momentum of cash flow is key to the survival of a faith-based currency.

A mass migration to Bitcoin would significantly contribute to reducing our wasted resources, and futile cultural addictions to materialism.

As the perceived value of fiat continues to fall in relation to Bitcoin, many will be tempted to exploit it to accumulate more fiat wealth. This is like moving your treasure to a sinking ship. With Bitcoin, we have an opportunity to build a new circular economy by the people, for the people – for ourselves and generations to come. An economy rooted in honesty, sound money, public consensus, and free of systemic theft is foundational to bringing about the next golden age.

Which economic system will you allocate your attention and energy to? Please share your thoughts below.